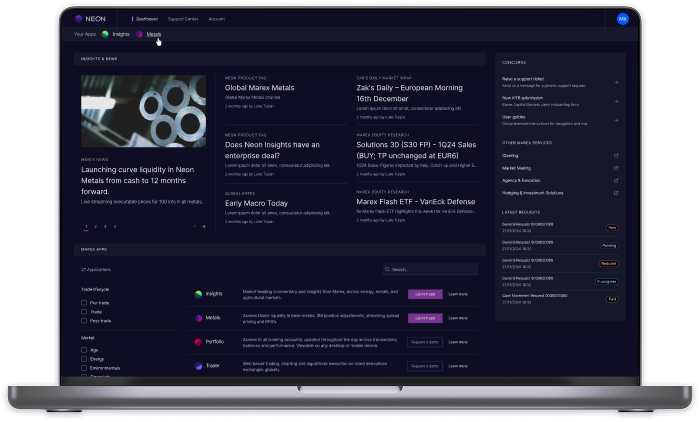

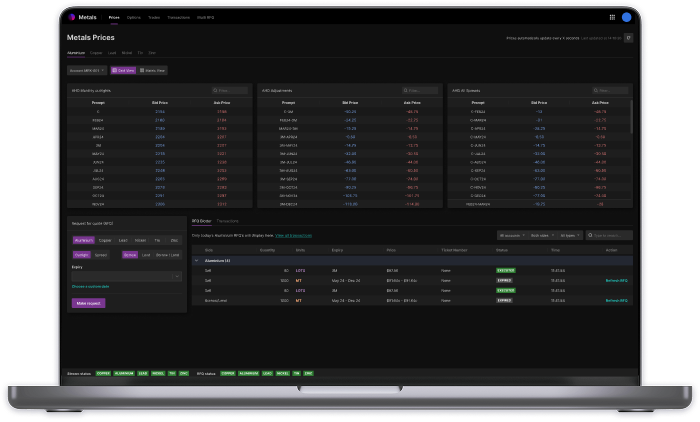

Neon Metals User Guide

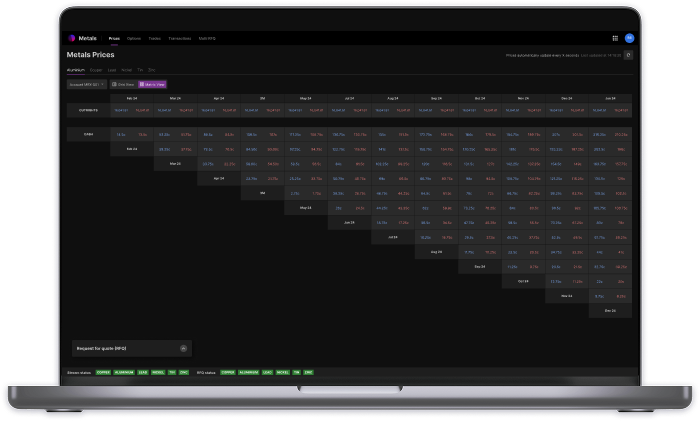

Neon Metals provides access to Marex’s proprietary liquidity throughout the LME trading day (02:00 – 19:00 London Time) across the curve for the six base metals: Copper, Aluminium, Lead, Zinc, Tin, and Nickel.

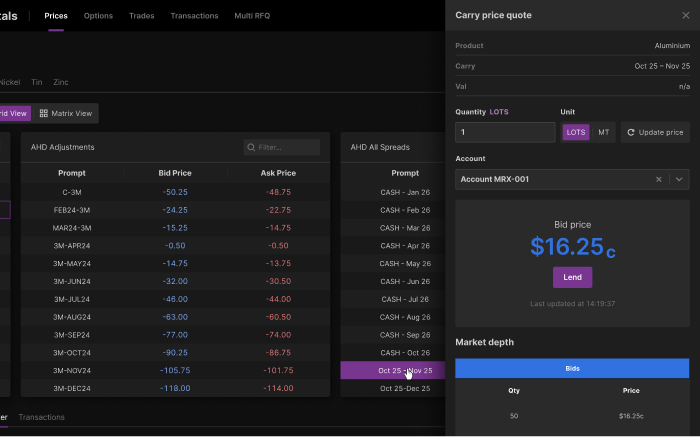

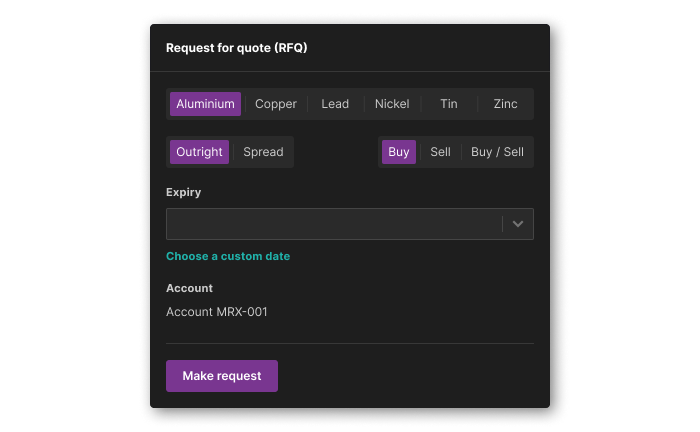

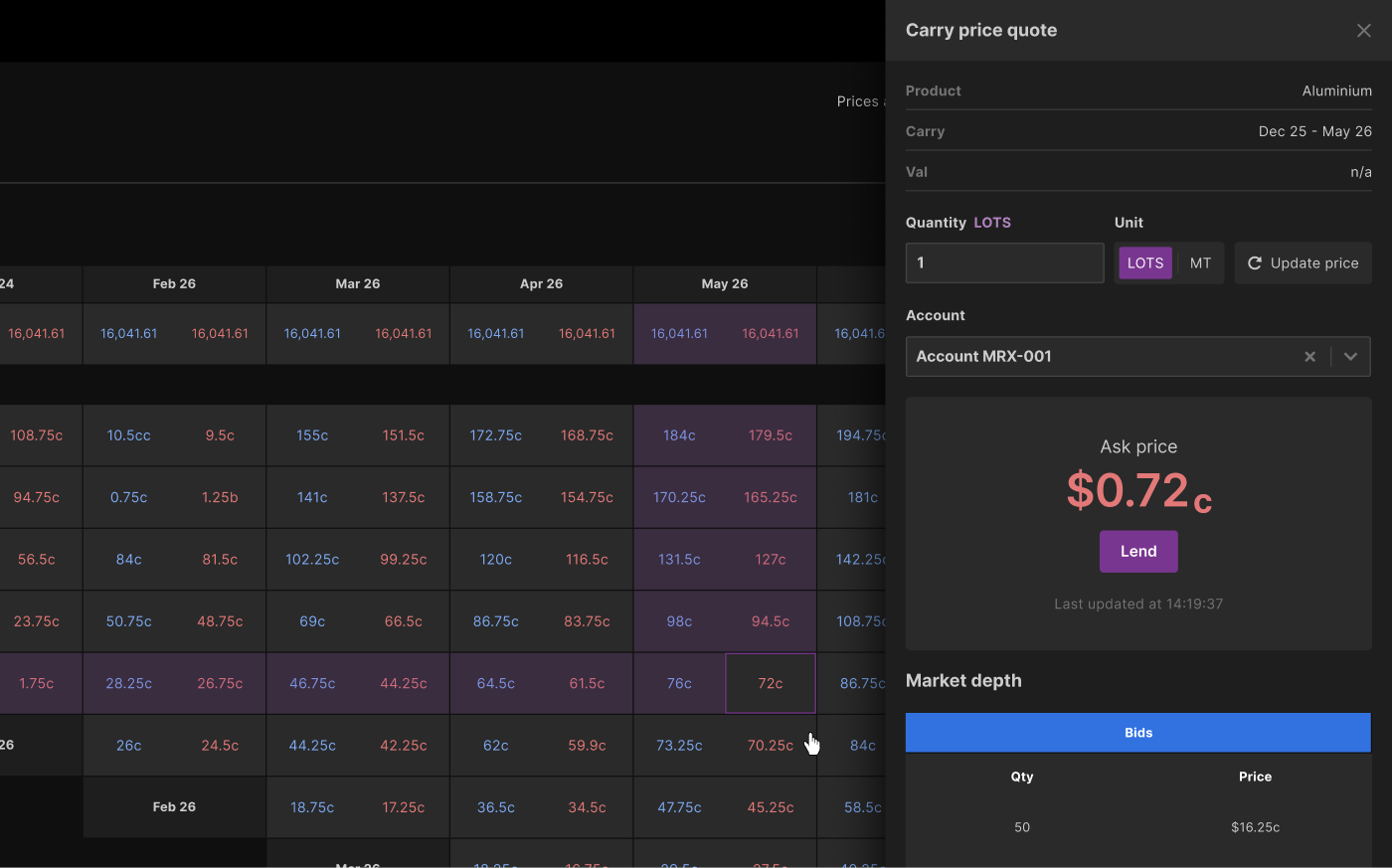

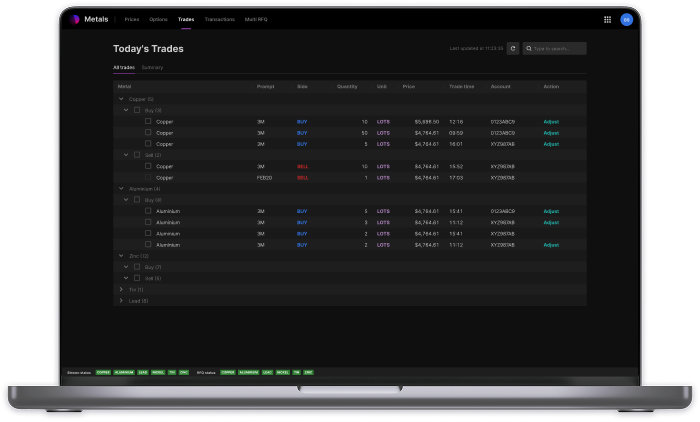

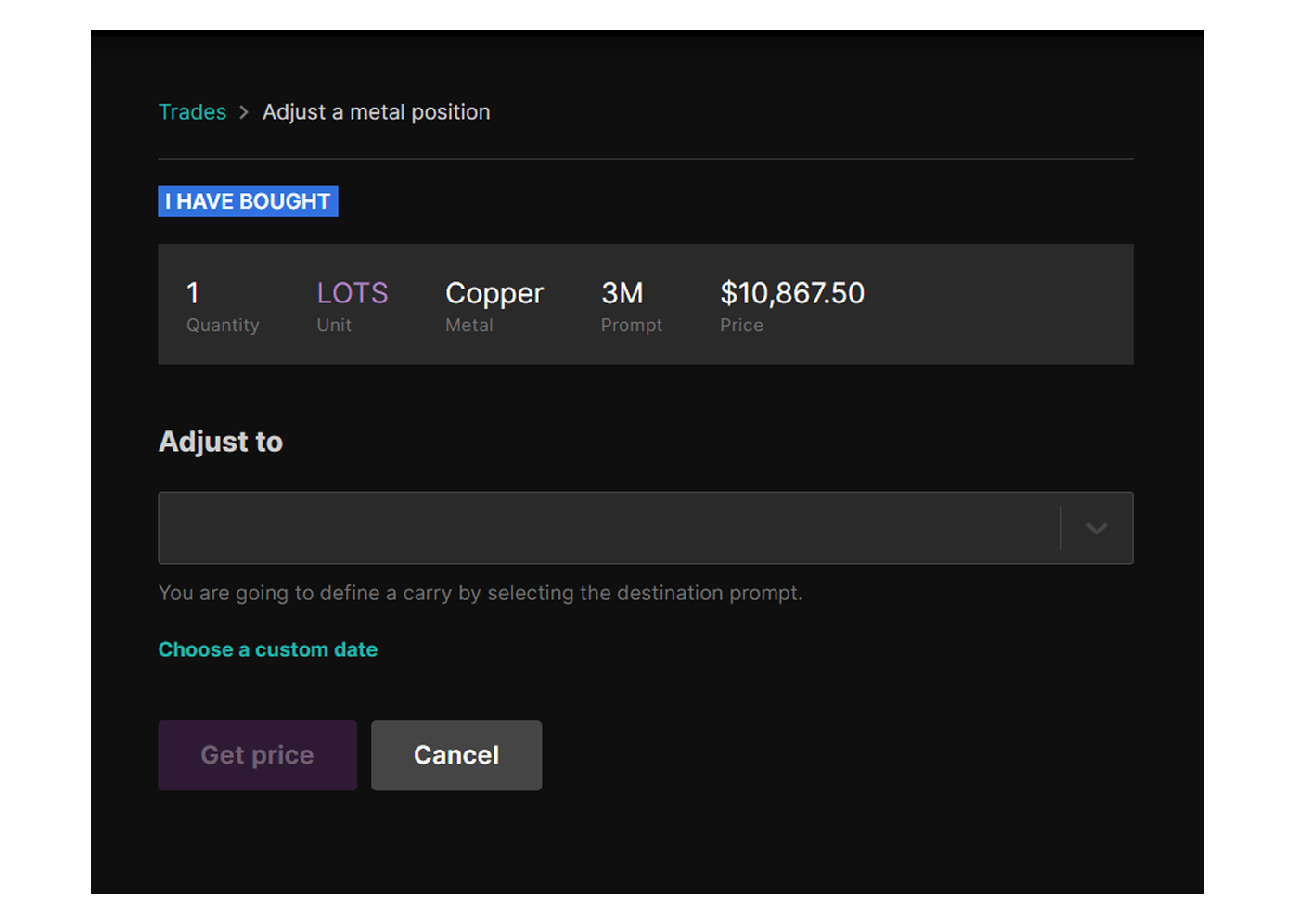

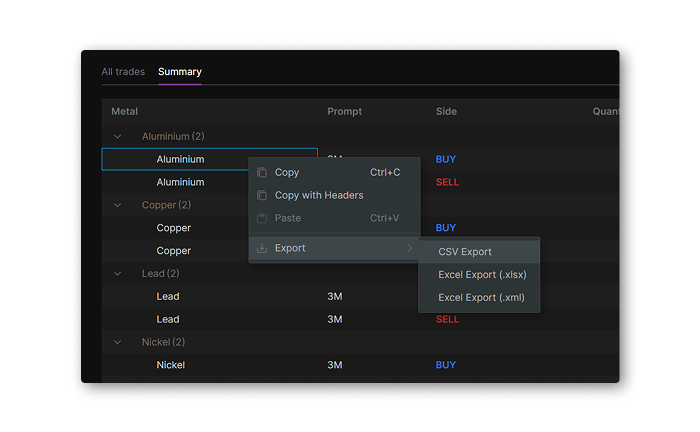

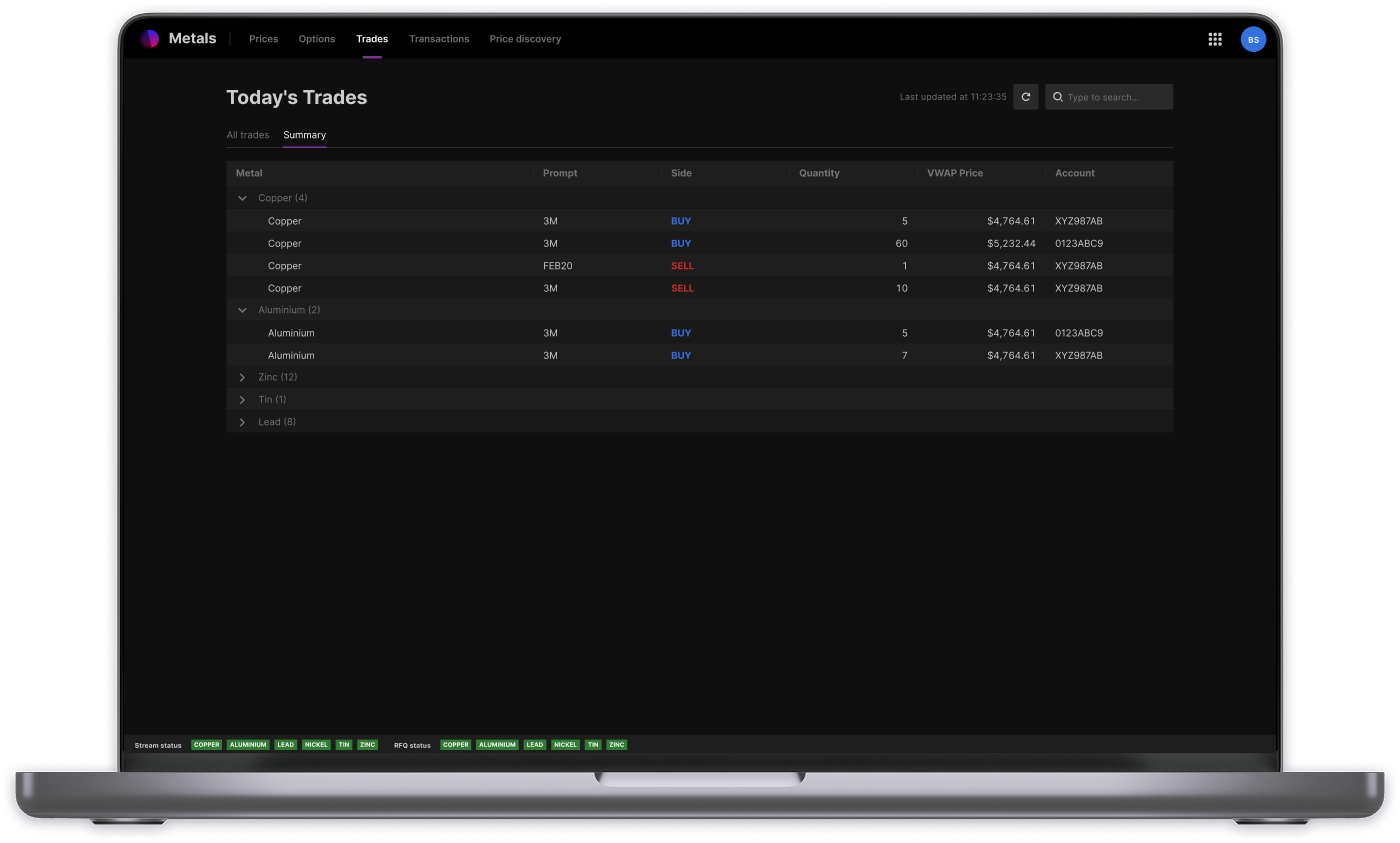

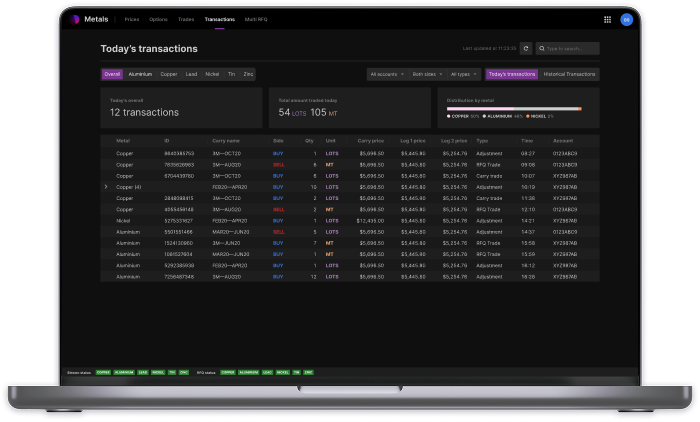

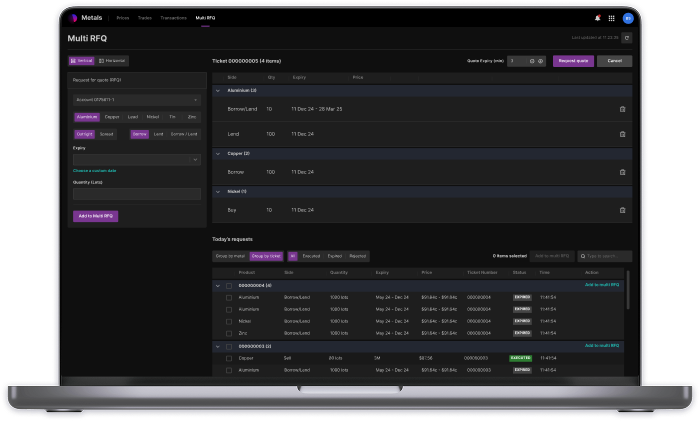

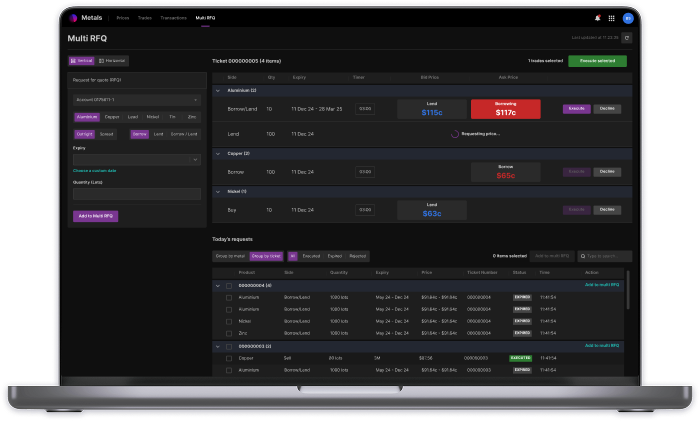

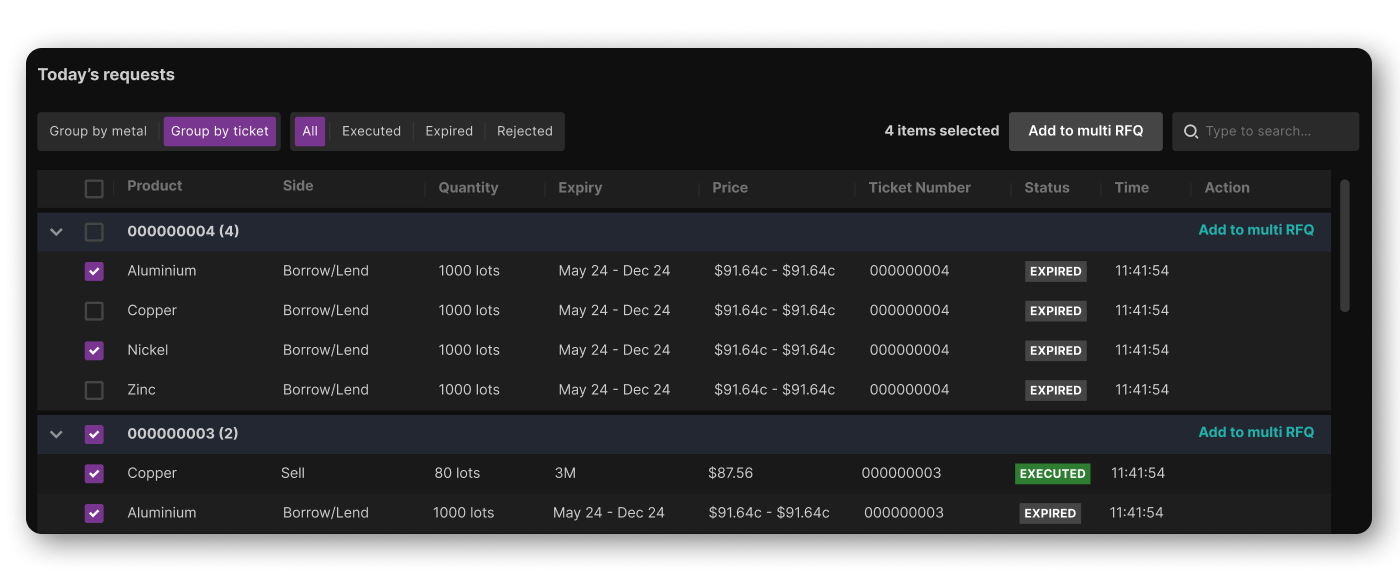

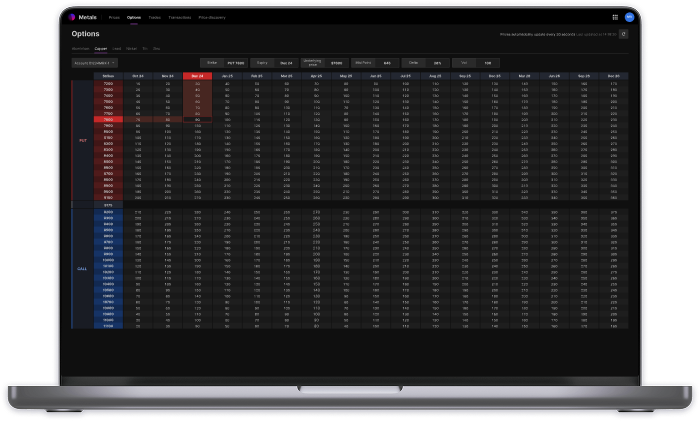

Metals is a comprehensive solution allowing trading via live-streaming prices and/or customizable quote requests for 3rd Wednesday outrights and all spreads. It offers voice/DMA 3M position adjustments across the curve, as well as indicative options quotes. Additionally, it provides visibility into top daily transactions and historical activity via a blotter.